College Bound & Covered: Essential Estate Planning Docs for Students

As a financial advisor, you play a vital role in guiding your clients toward a secure and prosperous financial future. While you’re likely already offering a comprehensive range of financial services, have you considered the significant advantages of including estate planning in your offerings?

10 digital marketing tactics to grow your financial advisory firm

Taking the leap to become an independent financial advisor is an enormous decision. Because you’re now responsible for everything in your business, the onus is on you to become an expert at everything – finance, compliance, tech – and marketing. To help you with your marketing efforts, and since there are only 24 hours in […]

5 Myths About Becoming an Independent Financial Advisor

There are a lot of misconceptions about becoming an Independent Financial Advisor. For those financial advisors considering independence, we know change can be scary and uncertain. You may be asking these questions: Will my clients follow me? Will my income be as good as it is now? How will I handle all the paperwork and back-office […]

How a growing RIA is using EOS to grow the right way

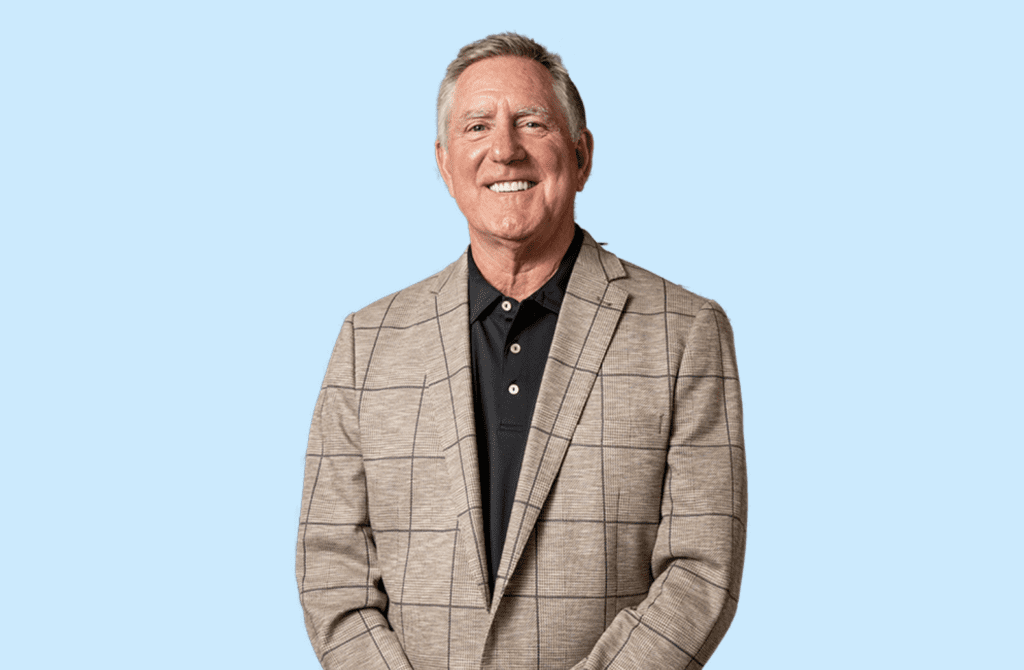

Bill Sowell started a journey 23 years ago to create a pathway of freedom for financial advisors. Committed to providing true independence for them, he founded a Registered Investment Advisory (RIA) firm to become the advisor to advisors. His firm has grown from just a few employees to more than 30 today and, with $4 […]

Executive Q&A: CEO Bill Sowell on Expanding into NWA

Succession Planning for Financial Advisors: Key Steps to Consider

Creating a succession plan is an essential step for a financial advisor to ensure the smooth transition of their practice and client relationships in the event of retirement, disability, or other unexpected circumstances. That said, a succession plan is more than a document spelling out who will take over the company you’ve built or grown. […]

Understanding RIA Compliance

Launching a solo advisory firm can be intimidating due to compliance management. Since you must complete many compliance tasks each year, we’ll walk through the ins and outs of creating your compliance calendar. This calendar can help you systematize and manage compliance tasks, requirements, and deadlines. As a solo Registered Investment Adviser (RIA) owner, you’ll […]

Sowell puts ‘boots on the ground’ in Northwest Arkansas

Why Financial Advisors Choose Independence – An insider’s view

Financial advisor Bill Sowell made the leap to independence more than three decades ago and he has never looked back. Since then, Sowell Management, the Registered Investment Advisor (RIA) firm he founded in North Little Rock, Arkansas, has grown exponentially. Since 2016, Sowell Management’s AUM/AUA* jumped from $525 million to $4 billion today and more […]

Electricity Tax is Around the Corner

According to Goldman Sachs Research, half of all vehicle sales are forecast to be electric vehicles by 2035, which is great for the environment and lower greenhouse gas emissions. They further forecast that global E.V. sales will reach 73 million units by 2040, with the U.S. accounting for 14 million units. Tesla’s current estimates are that a Tesla Model 3 Long Range with a 75kWh battery pack costs approximately $21 for a full charge ($0.28/kWh) at a Supercharging station – an annual savings of $700 estimated by Tesla. That is a huge cost saving relative to the price of gas, “fueling” the adoption of E.V.s even sooner. But consumers beware, “If it’s too good to be true, it probably is.” Currently, California tacks on an additional $1.40 “per gallon” in fuel taxes and fees; the $1.40 per gallon includes 54 cents in state excise tax, 18.4 cents in federal excise taxes, 23 cents for California’s cap-and-trade program to lower greenhouse gas emissions, 18 cents for the state’s low-carbon fuel programs, 2 cents for underground gas storage fees, and an average of 3.7% in state and local sales taxes. California expects to raise $7.4 billion in budget revenue from its state excise tax to pay for road infrastructure and other government infrastructure projects. As the consumption of gas declines, so will the state and federal revenue to fund our transportation system. In 2020, Statista.com reported U.S. states and local governments collected $53 billion in gas tax revenue, and some of the top states are PA, CA, WA, IL, and NJ. Where’s the shortfall in gas tax revenue going to come from? Policymakers are already spinning their wheels, but rest assured it will likely come from an increase in the cost of your annual vehicle registration, driver’s license renewal, auto insurance, and last but not least, a tax on the energy that charges your E.V. battery and home, electricity! If E.V. savings now is too good to be true, it only means you should buy an E.V. sooner rather than later to enjoy the benefits now before they disappear.